Summer 2024 UK Property Market Report: Building momentum

Posted on: Wednesday, June 12, 2024

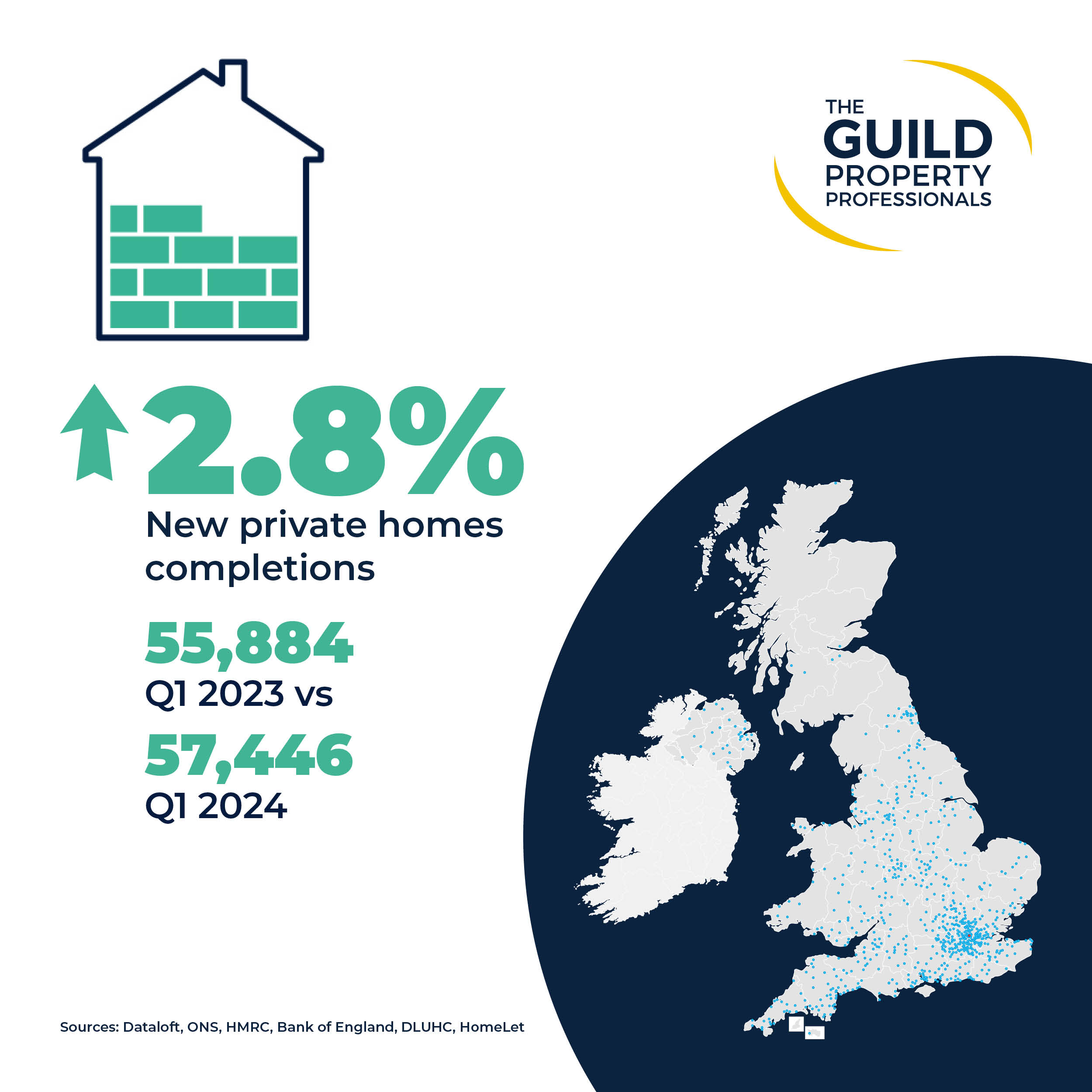

The property market continues its steady recovery. As momentum builds, buyer demand, transaction levels and prices are rising. All eyes are on the Bank of England for an imminently expected interest rate cut.

Interest rate

The UK economy grew by 0.6% between January and March 2024, marking the end of the recession (ONS). With inflation falling to just 2.3% in the 12 months to April 2024, close to its 2% target (ONS), the Bank of England is widely anticipated to cut the base rate imminently. Economists at Capital Economics are forecasting the base rate to be at 4.5% by the end of 2024, with the first cut expected in August. With the economic outlook brightening, consumer confidence in May rose to its highest level since December 2021 (GfK Consumer Confidence Tracker).

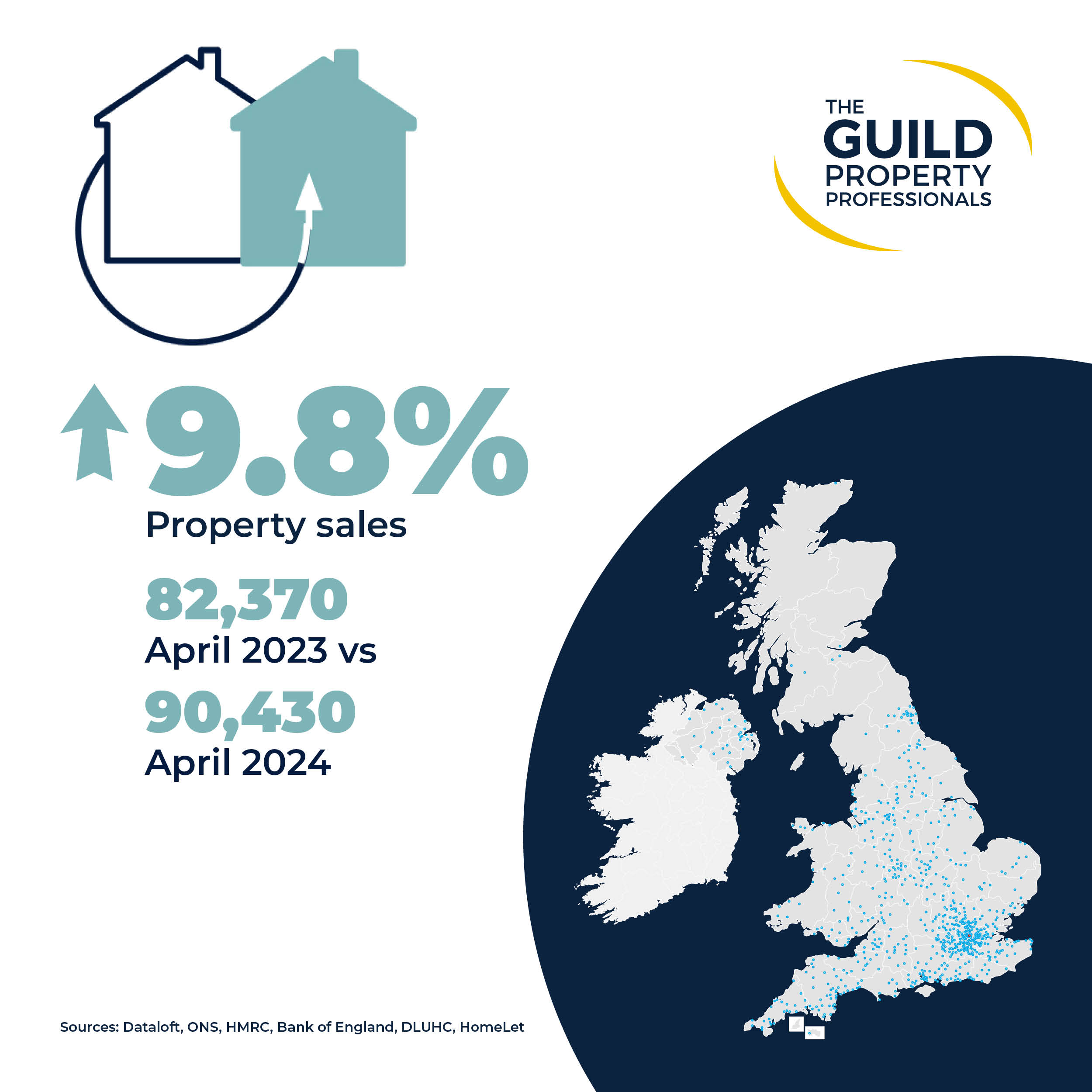

Market dynamics

Despite borrowing costs being more expensive than the ultra-low period a few years ago, the recent stability has meant that homeowners can be confident in their ability to afford a mortgage and can benefit when rates do fall. With a widely expected base rate cut alongside the usual spring optimism, almost two-thirds of agents say that buyer confidence has improved compared to three months ago (Dataloft by PriceHubble (poll of subscribers)). Mortgage approvals reached 61,140 in April, a significant annual increase of 26% and only the second month since August 2022 that approvals have topped 61,000 (Bank of England).

Election

Rishi Sunak has announced a 4th July general election. Some fear an election could stall market activity, but this was typically when a significant policy change, such as Mansion tax, was mooted, which isn’t the case this time round. The first interest rate drop is expected to have a larger impact on activity this year. The election is unlikely to interrupt seasonal patterns of transactions, which typically peak in July and August anyway (Dataloft (PriceHubble), HMRC). With the sales pipeline already 3% higher than this time last year (Zoopla) it's unlikely that buyers already in the process of working to a sale will pull out.

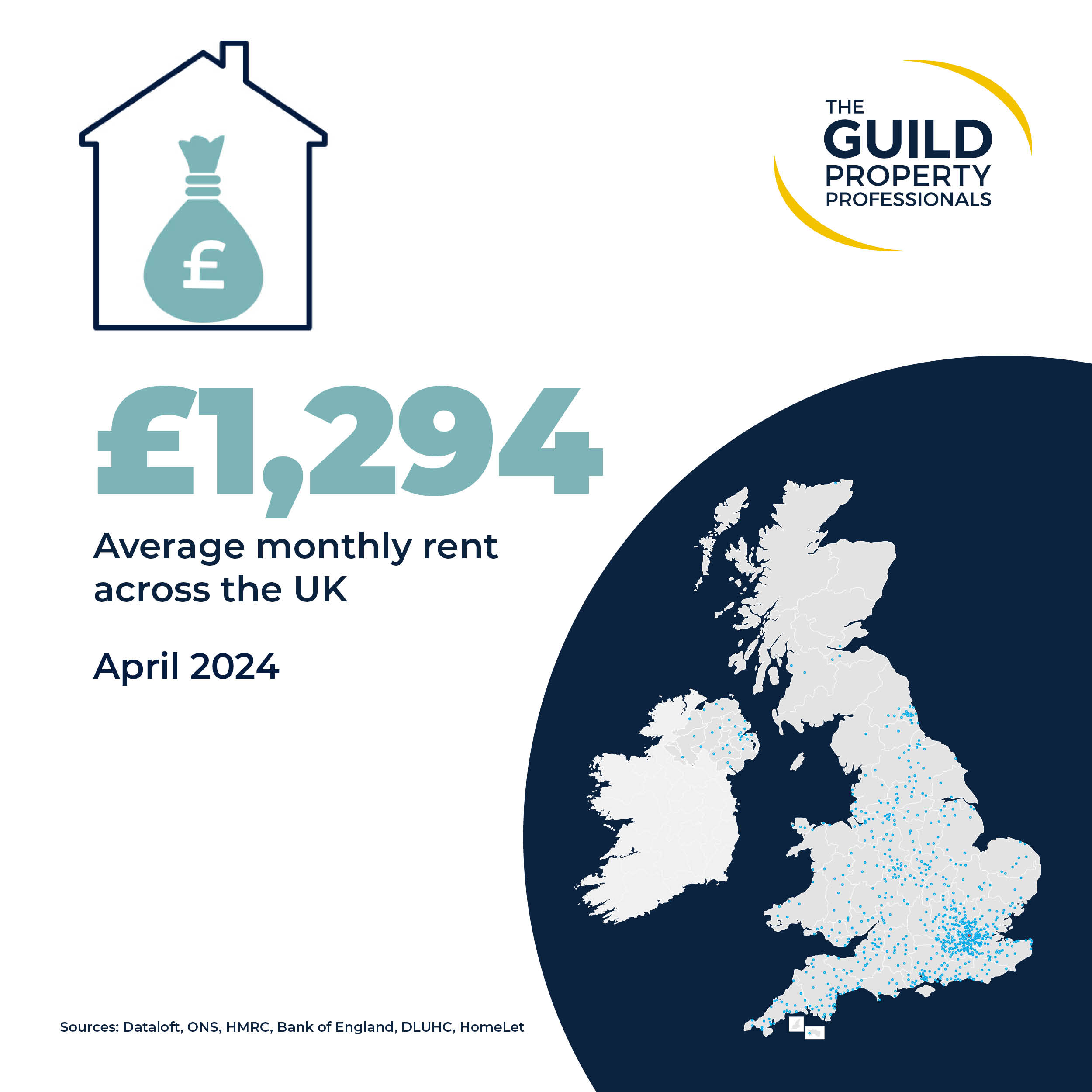

Lettings

Average rents rose by 1.6% to a new high of £1,294 per month in April, the highest monthly increase since August 2021. Year-on-year rents are up 7.9%, slightly moderated from the highs of 10%+ growth in summer 2023. Rental demand has declined by a fifth over the last year (Zoopla) as temporary pandemic effects fade away and renter affordability becomes increasingly stretched. Despite this, demand continues to outstrip supply and rents are forecast to grow, although at a slightly slower pace than the recent highs. As we move into the typically busier warmer months, 89% of agents report 6 or more applicants for each listing on the rental market, with a further 55% reporting 11 or more (Dataloft by PriceHubble (poll of subscribers)).

Regional Reports

Browse our Regional Market Reports:

● Market Report 2024 Summer East Midlands

● Market Report 2024 Summer Essex, Norfolk and Suffolk

● Market Report 2024 Summer Hertfordshire,Bedfordshire and Cambridgeshire

● Market Report 2024 Summer London

● Market Report 2024 Summer North East, and Yorkshire and The Humber

● Market Report 2024 Summer Northern Ireland

● Market Report 2024 Summer Scotland

● Market Report 2024 Summer Devon and Cornwall

● Market Report 2024 Summer Southern Home Counties

● Market Report 2024 Summer South East Home Counties

● Market Report 2024 Summer Southern

● Market Report 2024 Summer Thames Valley

● Market Report 2024 Summer West of England

● Market Report 2024 Summer West Midlands

● Market Report 2024 Summer North West

● Market Report 2024 Summer Wales

Contact us

Sell your property with your local expert this summer. Contact your local Guild Member today.

How Much is Your Property Worth?

Not sure how much your property is worth? Request a free, no obligation valuation for your property.

Book a Valuation